- MONTHLY PAYMENT FORMULA MATH CALCULATOR HOW TO

- MONTHLY PAYMENT FORMULA MATH CALCULATOR FULL

- MONTHLY PAYMENT FORMULA MATH CALCULATOR CODE

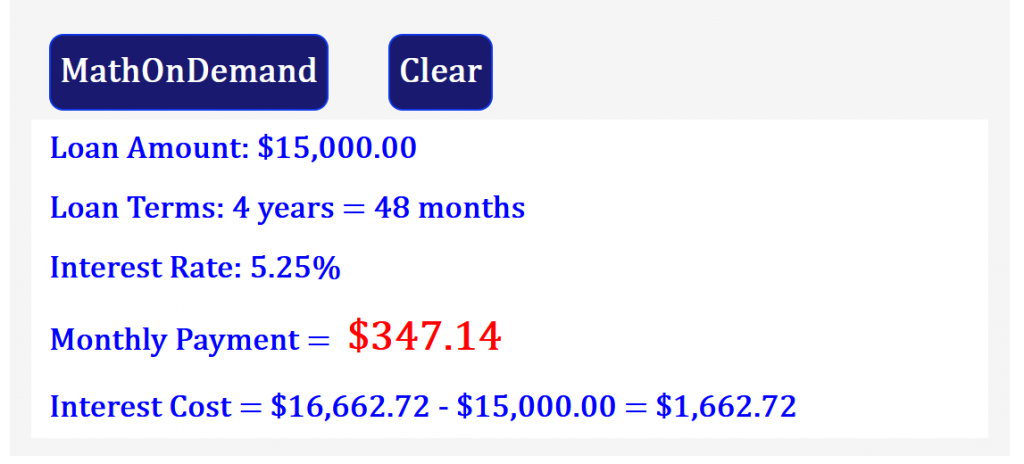

Once you click the 'calculate' button, the personal loan calculator will show you: If you wish, you can alter the start loan date and include any extra fees or balloon payments. To begin your calculation, enter the amount you are hoping to borrow along with the yearly interest rate and the number of months that you are intending toīorrow the money for.

MONTHLY PAYMENT FORMULA MATH CALCULATOR HOW TO

Advertisements How to calculate personal loan payments To assist in the decision-making process, has put together an excellent article about the advantagesĪnd disadvantages of paying off a mortgage loan early, with some ideas on how best to do it. So, it's important you don't leave yourself short.

Payments in the future, or to allow you to skip a payment. When making extra payments, it's important to remember that paying off the loan more quickly is unlikely to allow you to reduce your minimum Payments, you can pay your loan off quicker and therefore reduce the amount of interest you will end up paying back by the end. Some types of loan allow you to make extra monthly or quarterly payments on top of the minimum monthly payment required.

MONTHLY PAYMENT FORMULA MATH CALCULATOR FULL

#working out the total cost of the repayment over the full term of the loan # repaymentCost = loanAmount * interestRate * (1+ interestRate) * numberOfPayments / ((1 + interestRate) * numberOfPayments -1)

MONTHLY PAYMENT FORMULA MATH CALCULATOR CODE

#THIS IS FROM ANOTHER BIT OF CODE THAT IS SUPPOSE TO BE RIGHT BUT ISNT. MonthlyRepaymentCost = loanAmount * interestCalculation * (1+interestCalculation) * numberOfPayments / ((1+interestCalculation) * numberOfPayments - 1) # * N = Number of Payments (repaymentLength) # * I = Interest Rate (for an interest rate of 5%, i = 0.05 (interestCalculation)

# * M = Monthly Payment (what were trying to find out) #working out the number of payments over the course of the loan period. #working out the interest rate to a decimal number #converting the string input variables to float RepaymentLength = input("How many years to repay your loan? \n") InterestRate = input("What is the interest rate on your loan? \n") LoanAmount = input("How much do you want to borrow? \n")

# This program calculates monthly repayments on an interest rate loan/mortgage. Then it calculates the monthly payments to the user. The basic concept of the excersise is to make a mortgage calculator that asks the user to input 3 pieces of information, Loan Amount, Interest Rate, and Loan Term (years) I am currently learning python through a video tutorial on youtube, and have come up against a formula I cannot seem to grasp, as nothing looks right to me.

0 kommentar(er)

0 kommentar(er)